All Categories

Featured

Table of Contents

Repayments can be paid monthly, quarterly, every year, or semi-annually for a guaranteed time period or forever, whichever is defined in the contract. Only the passion portion of each settlement is considered gross income. The remainder is thought about a return of principal and is devoid of revenue tax obligations. With a delayed annuity, you make regular premium payments to an insurance provider over a duration of time and enable the funds to build and earn passion throughout the accumulation stage.

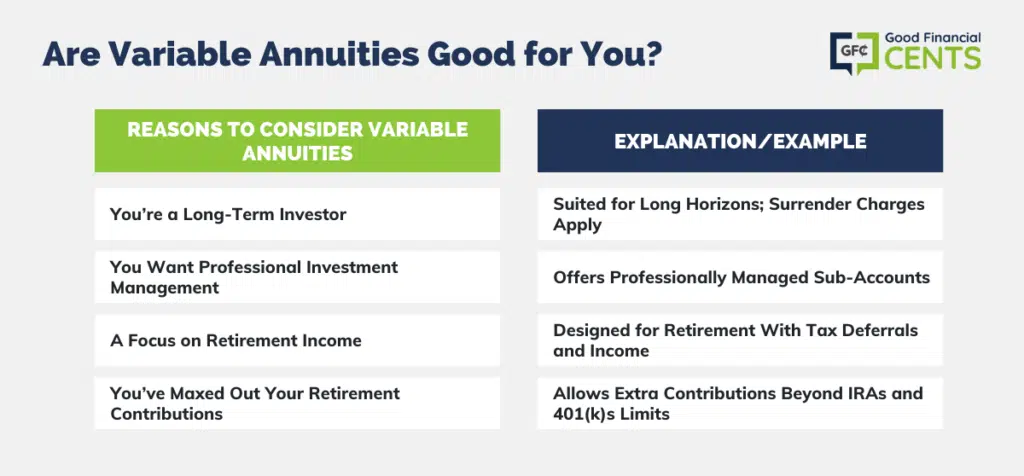

This suggests an annuity may aid you accumulate much more over the long term than a taxed investment. Any type of revenues are not taxed until they are taken out, at which time they are considered ordinary income. A variable annuity is an agreement that supplies changing (variable) instead of set returns. The key feature of a variable annuity is that you can manage how your premiums are invested by the insurance coverage business.

A lot of variable annuity agreements supply a selection of properly managed profiles called subaccounts (or investment alternatives) that buy supplies, bonds, and cash market instruments, along with balanced investments. Some of your contributions can be placed in an account that supplies a set price of return. Your costs will certainly be alloted amongst the subaccounts that you pick.

These subaccounts rise and fall in value with market problems, and the principal may be worth much more or much less than the original cost when surrendered. Variable annuities provide the dual advantages of financial investment adaptability and the potential for tax obligation deferment. The tax obligations on all passion, returns, and funding gains are deferred until withdrawals are made.

Understanding Financial Strategies A Comprehensive Guide to Investment Choices Breaking Down the Basics of Annuities Variable Vs Fixed Pros and Cons of Fixed Vs Variable Annuity Pros Cons Why Fixed Vs Variable Annuity Pros Cons Can Impact Your Future Fixed Income Annuity Vs Variable Annuity: A Complete Overview Key Differences Between Variable Vs Fixed Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Variable Annuity Vs Fixed Indexed Annuity FAQs About Annuities Variable Vs Fixed Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Vs Variable Annuities A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

The syllabus, which contains this and other details concerning the variable annuity contract and the underlying investment options, can be obtained from your financial expert. Be sure to check out the syllabus meticulously prior to making a decision whether to spend. The information in this e-newsletter is not meant as tax obligation, legal, investment, or retirement recommendations or suggestions, and it may not be depended on for the function of staying clear of any kind of government tax fines.

2025 Broadridge Financial Solutions, Inc.

2 of the most typical options include taken care of and variable annuities. The primary distinction between a repaired and a variable annuity is that dealt with annuities have an established rate and aren't linked to market efficiency, whereas with variable annuities, your eventual payout depends on just how your selected investments perform.

You can choose just how much money you intend to contribute to the annuity and when you intend to begin obtaining revenue payments. Generally speaking, taken care of annuities are a foreseeable, low-risk means to supplement your earnings stream. You can fund your taken care of annuity with one round figure, or a collection of payments.

You can fund a fixed or variable annuity with either a lump amount, or in installations over time. Most of the time, variable annuities have longer build-up periods than repaired annuities.

Breaking Down Fixed Annuity Vs Variable Annuity Everything You Need to Know About Fixed Income Annuity Vs Variable Annuity Defining Variable Annuity Vs Fixed Indexed Annuity Features of Smart Investment Choices Why Variable Vs Fixed Annuity Is a Smart Choice Variable Vs Fixed Annuities: How It Works Key Differences Between Immediate Fixed Annuity Vs Variable Annuity Understanding the Risks of Fixed Annuity Or Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Index Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Fixed Annuity Or Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Annuity Or Variable Annuity

Both repaired and variable annuities provide you the opportunity to get in the annuitization stage, which is when you obtain money from your annuity. With dealt with annuities, you'll obtain earnings in fixed installations that are ensured to remain the exact same.

This could be one decade, 20 years, or permanently. The abandonment duration is the time structure throughout which you can't take out funds from your annuity without paying added fees. Give up durations usually relate to just postponed annuities so they can relate to both dealt with deferred annuities and variable annuities.

Living advantages affect the income you receive while you're still to life. For instance, you could intend to add a guaranteed minimum buildup worth (GMAB) biker to a variable annuity to ensure you won't lose cash if your financial investments underperform. Or, you might wish to add a cost of living change (SODA POP) biker to a fixed annuity to aid your settlement amount stay up to date with inflation.

If you would certainly such as to begin receiving revenue payments within the next 12 months, an instant fixed annuity would likely make even more sense for you than a variable annuity. You can consider a variable annuity if you have even more of a resistance for danger, and you would certainly such as to be a lot more hands-on with your investment selection.

Among these differences is that a variable annuity might provide payment for a life time while shared funds may be diminished by withdrawals on the account. Another crucial difference is that variable annuities have insurance-related costs and shared funds do not. With every one of the major and small differences in dealt with annuities, variable annuities, and mutual funds, it is essential to seek advice from with your economic expert to make sure that you are making clever cash decisions.

In a dealt with annuity, the insurance coverage business ensures the principal and a minimal interest rate. To put it simply, as long as the insurance coverage company is financially sound, the cash you have actually in a dealt with annuity will grow and will certainly not go down in worth. The growth of the annuity's worth and/or the benefits paid might be dealt with at a buck quantity or by a rate of interest rate, or they may grow by a specified formula.

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Explained in Detail Key Differences Between Fixed Income Annuity Vs Variable Growth Annuity Understanding the Rewards of Deferred Annuity Vs Variable Annuity Who Should Consider Fixed Annuity Vs Equity-linked Variable Annuity? Tips for Choosing Fixed Income Annuity Vs Variable Growth Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Index Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

A lot of variable annuities are structured to supply capitalists many various fund options. An equity-indexed annuity is a kind of fixed annuity, but looks like a crossbreed.

This withdrawal versatility is attained by readjusting the annuity's worth, up or down, to show the change in the rate of interest "market" (that is, the basic degree of rates of interest) from the beginning of the picked time duration to the time of withdrawal. All of the following kinds of annuities are readily available in taken care of or variable kinds.

The payment may be a really lengthy time; postponed annuities for retired life can stay in the deferred stage for years. An immediate annuity is designed to pay an income one time-period after the immediate annuity is purchased. The moment duration depends upon just how usually the revenue is to be paid.

Exploring Fixed Indexed Annuity Vs Market-variable Annuity A Closer Look at How Retirement Planning Works What Is Annuities Fixed Vs Variable? Features of Smart Investment Choices Why Immediate Fixed Annuity Vs Variable Annuity Is a Smart Choice How to Compare Different Investment Plans: Explained in Detail Key Differences Between Deferred Annuity Vs Variable Annuity Understanding the Risks of Long-Term Investments Who Should Consider Deferred Annuity Vs Variable Annuity? Tips for Choosing Fixed Annuity Vs Equity-linked Variable Annuity FAQs About Fixed Income Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Fixed Vs Variable Annuity Pros Cons A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

A set period annuity pays a revenue for a given amount of time, such as ten years. The amount that is paid does not depend on the age (or proceeded life) of the individual who gets the annuity; the payments depend rather on the quantity paid right into the annuity, the length of the payout period, and (if it's a set annuity) an interest rate that the insurance business thinks it can sustain for the length of the pay-out duration.

A variant of life time annuities continues revenue until the 2nd one of 2 annuitants passes away. Nothing else kind of economic item can promise to do this. The quantity that is paid depends on the age of the annuitant (or ages, if it's a two-life annuity), the quantity paid into the annuity, and (if it's a fixed annuity) a rates of interest that the insurance provider believes it can support for the size of the expected pay-out duration.

Many annuity buyers are uneasy at this opportunity, so they add a guaranteed periodessentially a fixed period annuityto their life time annuity. With this mix, if you pass away before the fixed duration ends, the income remains to your recipients up until the end of that period. A qualified annuity is one made use of to invest and disburse money in a tax-favored retirement strategy, such as an IRA or Keogh strategy or plans controlled by Internal Profits Code sections, 401(k), 403(b), or 457.

Table of Contents

Latest Posts

Exploring Tax Benefits Of Fixed Vs Variable Annuities A Closer Look at How Retirement Planning Works Breaking Down the Basics of Variable Annuities Vs Fixed Annuities Pros and Cons of Various Financia

Highlighting Indexed Annuity Vs Fixed Annuity Key Insights on Your Financial Future What Is Variable Annuity Vs Fixed Annuity? Advantages and Disadvantages of Variable Annuity Vs Fixed Annuity Why Cho

Highlighting Retirement Income Fixed Vs Variable Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Annuity Fixed Vs Variable Advantages and Disadvantages of Different Ret

More

Latest Posts